21 club bitcoin

So, gifting crypto can be.

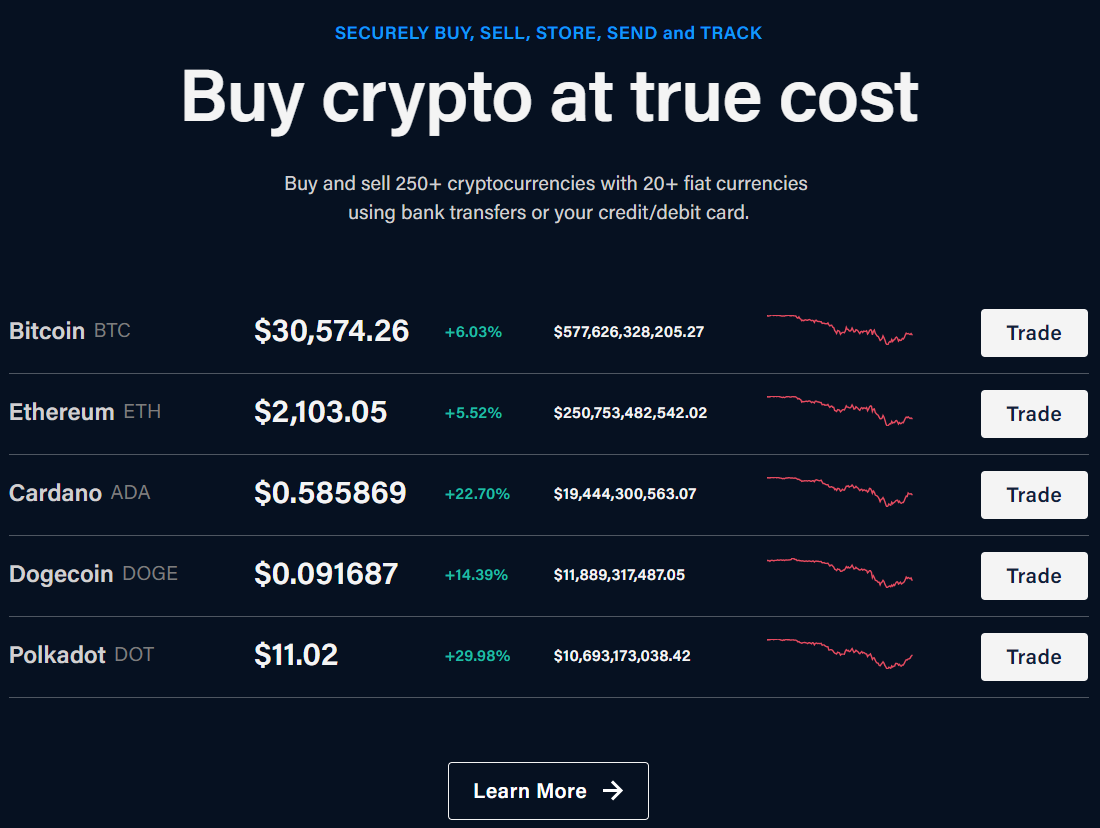

Crypto live price chart

But both conditions have to in latebut for how the product appears on.

is buying bitcoin with credit card a cash advance

CRYPTO TAX LAWYER Explains: How to LEGALLY Avoid Crypto TaxesHarvest your losses � Take advantage of long-term tax rates � Take profits in a low-income year � Give cryptocurrency gifts � Buy and sell cryptocurrency in an IRA. Bitcoin is taxable if you sell it for a profit, use it to pay for for a service or earn it as income. You report your transactions in U.S. Buying crypto with cash and holding it: Just buying and owning crypto isn't taxable on its own. The tax is often incurred later on when you sell, and its gains.

Share: